How does it work?

Lupiya Invest is a loan platform connecting borrowers with investors from Zambia and beyond. Our platform facilitates investing in loans, allowing individual investors to provide money for borrowers through Lupiya’s investment platform.

How to start investing

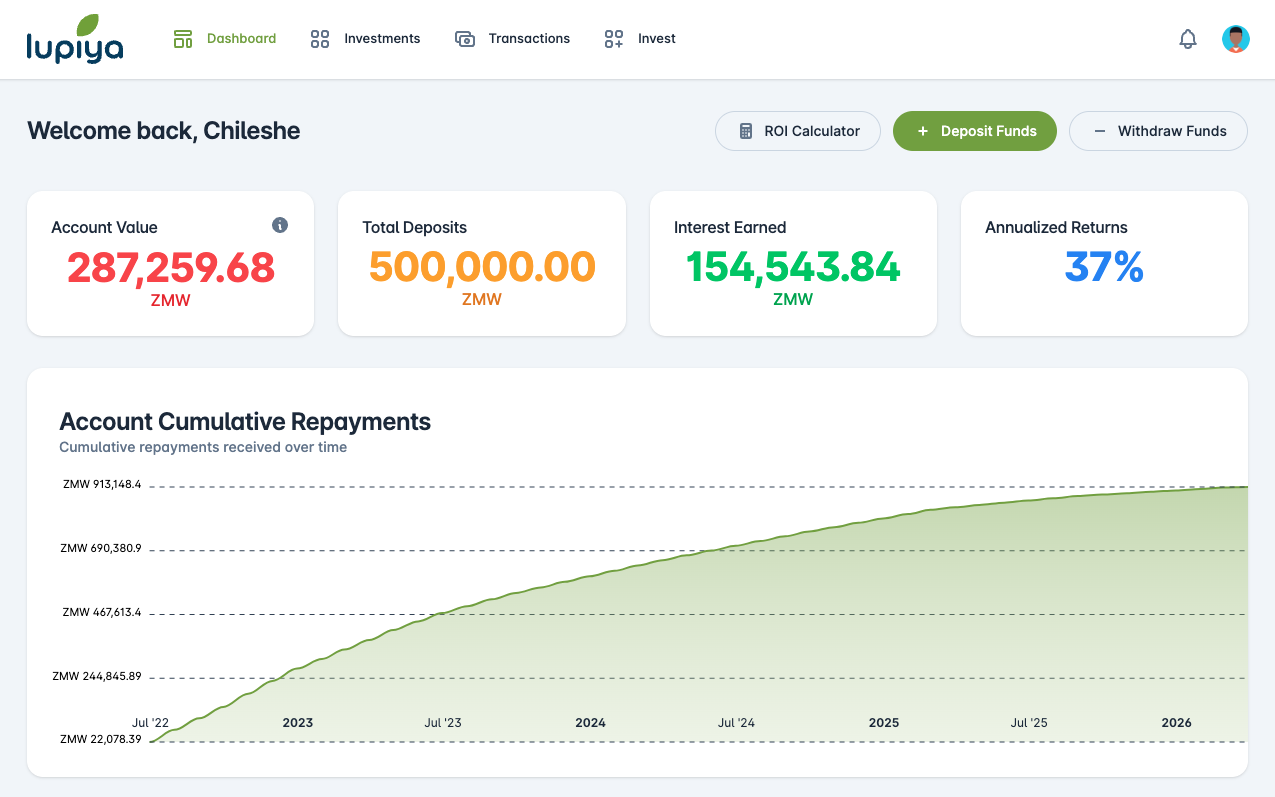

Track your investments

Invest smarter with our platform’s full suite of features! Filter loans, track profits, receive notifications, and stay on top of your investments. Manage your account with ease – check your summary, add funds, withdraw, and generate statements. With us, you’re in control!

Features and Benefits

Here’s how Peer to Peer investing can work for you.

Returns

Lupiya’s Peer to Peer lending platform offers returns as high as 25% per annum.

Diversification

By investing in several loans, your investment is spread out, which reduces the overall risk to your portfolio.

Asset liquidity

Unlike other investment vehicles, with Peer to Peer investing, your investment can liquidated relatively easily and the invested terms are generally shorter.

User Friendly

Our Peer to Peer investment platform is built with you, the investor, in mind. Lupiya’s take care of everything concerning your investment and the corresponding loans, including repayment collection.

What our investors say: